G’day and welcome to your weekly edition of Overnight Success - your download on all the important things that have happened in the Aussie startup ecosystem. 🚀 A special g’day to the 70 subscribers who joined since last week! 👋

If you get value from Overnight Success, consider becoming an OS superhero so we can invest in the platform for a massive 2026!

👀 Headlines 👀

📈 Rokt is courting investors ahead of a 2026 IPO or liquidity event, meeting with North American and Australian funds as it races past $1 billion in annual revenue. (AFR)

Morgan Stanley has quietly been preparing the ground for months, with Goldman Sachs and Barrenjoey also circling potential sell-side roles if Rokt proceeds with a multibillion-dollar deal.

The adtech giant is weighing a dual Nasdaq–ASX listing in 2026, a world-first, but may still opt for a private round to deliver early shareholders an exit.

Rokt’s “point-of-transaction” ad platform now supports 2000 e-commerce partners and grew revenue 48% to $US743m, with forecasts topping $US1b by August 2026.

Investor appetite remains strong despite fluctuating valuations, with secondary trades in 2025 ranging from $5.6b to $7.2b as MA Financial’s latest deal priced the company at $US4.1b.

Early investors include Tiger Global Management, which led the Series E funding round, and Square Peg, which has reportedly brought in seven times in 12 years.

✂ Culture Amp has cut 6% of staff (around 60 roles) as it pivots aggressively toward AI products (Capital Brief)

The layoffs are tied directly to accelerating development of Culture Amp’s new AI Coach, reflecting a deeper repositioning as customers demand predictive, automated, cost-saving tools rather than survey-centric software.

👀 Sex-tech startup Normal turns to Birchal crowdfunding. (Overnight Success)

Female-founded and 100% founder-owned, Normal was incubated by Eucalyptus (backed by Blackbird, Bond, W23) and is positioning itself as an education-first consumer tech brand.

Reportedly, the startup passed VC investment committee meetings before being vetoed by vice clauses, highlighting the ongoing stigma around sexual wellness despite Normal’s tens of millions of education content views.

Normal is targeting $500k–$1m in revenue, with capital earmarked for B2B expansion, new recurring consumables, and growing its free sex-education library.

The raise will build on Normal’s 40,000+ customers and 200k+ social followers.

🧓Australia’s retirees are reportedly missing out on up to $20,300 in missed returns by Superfunds not investing in startups and high-growth companies. (AFR)

Despite VC and PE delivering post-fee returns of 18.2%, around 11 percentage points higher than listed assets, Australian super funds allocate just 4.4% to the asset class versus 14% at leading global pension funds.

The report, conducted for the Australian Investment Council, found that regulatory barriers were causing funds to withhold at least $54 billion from funding private equity and venture capital.

Industry leaders blame “regulatory barnacles” like RG97 and the Your Future, Your Super performance test for pushing funds toward low-fee products at the expense of long-term, high-growth investments.

Critics argue cultural risk-aversion is also to blame, with Tanarra Capital’s John Wylie saying super funds enjoy guaranteed inflows yet fail to back local innovation that drives future job creation.

Hostplus remains the standout backer of Australian VC, while others like AustralianSuper and HESTA lag despite evidence that higher alternative allocations could boost member outcomes without raising contributions.

🥼 The IMF has urged Treasurer Jim Chalmers to reverse Australia’s steep decline in R&D investment and use technologies like AI to lift innovation, productivity, and long-term competitiveness. (Innovation Aus)

Australia’s R&D spend has fallen from 2.25% to 1.66% of GDP, now less than half the OECD average, and the IMF warns this drop is becoming a major drag despite the nation’s strong institutions and economic stability.

The IMF is calling for comprehensive tax reform, including a potential resource-revenue tax, higher indirect taxes, and fewer income-tax exemptions, to enable lower corporate and labour taxes and spur investment. Read the full IMF statement here.

🏭 US AI-chip startup Groq has launched its first Australian data-centre hub in Sydney, deploying 7,776 custom “Language Processing Unit” chips as part of a planned US$300m regional expansion. (Innovation Aus)

The new 4.5-megawatt facility at Equinix SY5 promises latency cuts of “many seconds” for Asia-Pacific users, with Groq claiming its LPUs deliver up to 5× the performance and at a lower cost than traditional GPUs. Equinix SY5 is Australia’s largest data centre.

Founder Jonathan Ross says Australia could become an export base for Groq’s AI compute, with nearly half of the company’s 2.5 million developers located in the Asia-Pacific and 30,000 in Australia.

Equinix says the local deployment will help organisations meet data-sovereignty rules while scaling AI workloads more cheaply and efficiently across the region.

👋 Meta will delete all Australian Instagram and Facebook accounts belonging to users under 16 by 10 December, giving affected teens 14 days’ notice to download their data. (ABC)

The move follows new government rules requiring major platforms to block under-16s or face fines of $49.5 million per breach. In response, American tech and media giants are urging Trump to reprimand Australia over the new laws. (AFR)

Compliance for Startups: Download the Checklist

As a startup founder, finding product-market fit is your top priority. But landing bigger customers requires ISO 27001 or SOC 2 compliance—a time-consuming process that pulls you away from building and shipping.

That’s where Vanta comes in. Join over 10,000 companies, including hundreds of startups like Atlassian, Relevance AI, FireAnt and Everlab who streamline compliance with Vanta’s automation and trusted network of security experts. Start with our ISO 27001 compliance checklist, which breaks down the process into clear steps—so you can spend less time on compliance and more time growing your business.

⚡ Startup Retro ⚡

Sphere raises $32M hitting a valuation of $150M, to ease international tax compliance

Founder: Nicholas Rudder

Australian-founded AI-native tax compliance software, Sphere, has surged to a valuation north of $150 million less than a year after launch, backed by some of Silicon Valley’s biggest names. Founded by ex-Macquarie banker Nicholas Rudder, the San Francisco–based company uses large language models to untangle complex cross-border tax rules, helping high-growth companies navigate GST, VAT and sales-tax obligations in real time.

Sphere has just raised $32 million from Andreessen Horowitz, Y Combinator, Felicis Ventures, and Australian fund Folklore Ventures, while partnering with Stripe and Airwallex for payments and remittances. The platform has already processed over $1 billion in transactions and counts Linktree, Dovetail, Deel, Eleven Labs and Lovable among its customers.

Rudder built Sphere after wrestling with international tax issues in his previous start-up and says accelerating regulatory crackdowns in Europe and the rise of real-time reporting are driving demand. Despite an increasingly crowded AI market, he’s unfazed by bubble fears, arguing there’s “no better time” to build in AI.

Rudder relocated to the US to tap a deeper, more competitive VC market and says Australia’s reputation, thanks to Atlassian and Canva, helps founders win global attention. Investors say Sphere is poised to “reshape global tax compliance” with AI-powered automation.

Due diligence: TechCrunch, AFR

The Memo lands $20M Series B to modernise the baby retail experience across Australia

Founders: Phoebe Simmonds and Kate Casey

The Memo, the fast-growing parenting retailer founded by Phoebe Simmonds and Kate Casey, has secured a $20 million minority investment from Pier 12 Capital (formerly Auctus Investment Group), the backer behind Petstock and Luxury Escapes. The deal will fuel a major retail expansion as the brand scales beyond its four existing stores.

Launched in 2019, The Memo set out to modernise the baby-retail experience with a candid, millennial-driven approach to pregnancy, birth and postpartum. The model has resonated: revenue is growing 40% year-on-year, and customers travel significant distances to shop in person.

With fresh capital, The Memo will open new stores in Perth, Fortitude Valley (Brisbane) and Mosman (Sydney) in 2026, tackling an industry dominated by Baby Bunting and other big-box retailers. Simmonds and Casey bring luxury-retail backgrounds from LVMH and Mecca Brands, applying high-touch service expectations like connecting with shoppers within 15 seconds of entry.

Pier 12 says The Memo is primed to lead the category with its curated assortment, experiential retail and strong leadership. The company is also expanding its postpartum skincare line, Due, with plans to wholesale and take the brand global.

Due diligence: AFR

Teacher Buddy raises $1.85M seed round to help reduce teacher burnout through AI productivity

Founders: Ben Sze and Matt Abraham

Melbourne-based EdTech startup Teacher’s Buddy has raised $1.85 million in seed funding to tackle the global teacher burnout crisis with an AI-powered productivity platform. The round was led by impact investor Giant Leap, with backing from Flying Fox Ventures, Co Ventures, Exhort Ventures, Saniel Ventures, and Soul Capital.

Founded in 2024 by Edrolo co-founder Ben Sze and veteran product leader Matt Abraham, Teacher’s Buddy aims to cut the crushing administrative workload behind teacher burnout. The platform offers an AI-enhanced workspace for planning, marking, report writing, lesson refinement and professional development—tasks that routinely push teachers beyond 50 hours per week.

Traction already has been strong, with 12,000 teachers across 130 countries having adopted the tool, alongside 15 schools in Australia and New Zealand. Teacher’s Buddy says users save an average of 12 days per term, including 32 hours on planning and 38 on marking alone.

Investors say the company is tapping into a long-ignored leverage point in education: teacher capacity. With AI finally capable of reshaping EdTech, Teacher’s Buddy plans to rapidly scale engineering and GTM teams and expand across Australia, New Zealand and the UK, targeting 30,000 teachers and 200 school partners within 12 months.

Due diligence: Overnight Success

MetroElectro raises $1M equity and $4M of debt to solve the commercial solar adoption incentive problem

Founder: Lloyd Heinrich

Sydney-based climate-tech startup MetroElectro has raised $5 million in debt and equity to tackle one of the biggest barriers to commercial solar: the long-standing “split incentive” between landlords and tenants. While over 30% of Australian homes have solar, commercial and industrial rooftops sit below 5% adoption.

The round includes a $4m debt facility from Ecotone Partners’ Planet Fund and $1m equity from returning investor Wavemaker Impact, which also backed the company’s pre-seed.

Founded in 2024, MetroElectro offers a solar-as-a-service model that eliminates upfront costs for both parties. The startup designs, funds, installs and maintains solar and battery systems, then sells cheaper renewable electricity directly to tenants, with contracts aligned to the length of their leases. Excess energy is sold back to the grid. For tenants, it’s instant bill relief; for landlords, it’s a capex-free building upgrade.

MetroElectro already has 50+ projects in its pipeline (20MW of solar, 20MWh of batteries) and early clients like Aramex, Linde Materials Handling and Bucher Municipal. The capital will scale its tech stack and project deployment, ahead of a planned $3m equity raise in early 2026.

Due diligence: Overnight Success, Business News Australia, Startup Daily

Medow Health lands $3M follow-on funding to automate medical reports for specialist doctors

Founder: Josh and Joel Freiberg

Sydney-based Medow Health, an AI platform automating specialist medical reports, has raised a $3 million follow-on round — led entirely by the same clinicians who backed its $2 million raise earlier this year. Founded by brothers Joel and Josh Freiberg, inspired by their father’s late-night paperwork as a respiratory physician, the company is quickly becoming one of Australia’s fastest-growing AI medtech players.

Medow’s platform now processes 100,000+ specialist consults per month, powering a 300% revenue surge in 2025 and supporting deployments across Australia, New Zealand and Southeast Asia. A major Australian hospital has also piloted the technology, underscoring growing demand for AI that integrates directly into existing clinical workflows.

The startup’s edge lies not just in AI automation but in deep interoperability: integrations with core medical systems like Meditech, Genie and an expanding suite of hospital platforms. The founders say the new capital will accelerate the rollout of AI products, expand nationwide system integrations, and push the company to profitability within 12 months.

Due diligence: Startup Daily

Gega Elements raises $925K pre-seed to refine semiconductor minerals in Australia

Founder: Mo Assefi and Oliver Nighjoy

Sydney-based Gega Elements has raised a $925k pre-seed round as it sets out to break China’s near-total dominance over two of the world’s most critical semiconductor minerals: gallium and germanium.

Founded in a makeshift garage metallurgy lab, Gega is developing advanced refining tech to process these materials, essential for AI infrastructure, EVs, defence systems, space tech and high-performance semiconductors. China currently controls 98% of global gallium and 68% of germanium supply, and has already restricted exports to the US.

Backed by UNSW Founders, Flying Fox Ventures, Investible, TRaCE, Salus Ventures, and grants from S3B and UNSW’s Defence Cohort, Gega aims to build the first non-Chinese startup refining capability in the world. Its process is 30–40% cheaper and 40% greener, designed to withstand future Chinese market dumping by being cost-competitive from day one.

Instead of relying on traditional mining, Gega extracts minerals from tailings dams and low-grade ore, tapping into millions of tonnes of waste material across Australia. Demand is surging as silicon reaches its limits — gallium-based chips now power everything from Tesla fast chargers to Nvidia AI cooling systems. With MoUs from major miners and global sample inflows, Gega believes Australia can become a strategic alternative in a market set to triple to $3B within eight years.

Due diligence: Capital Brief

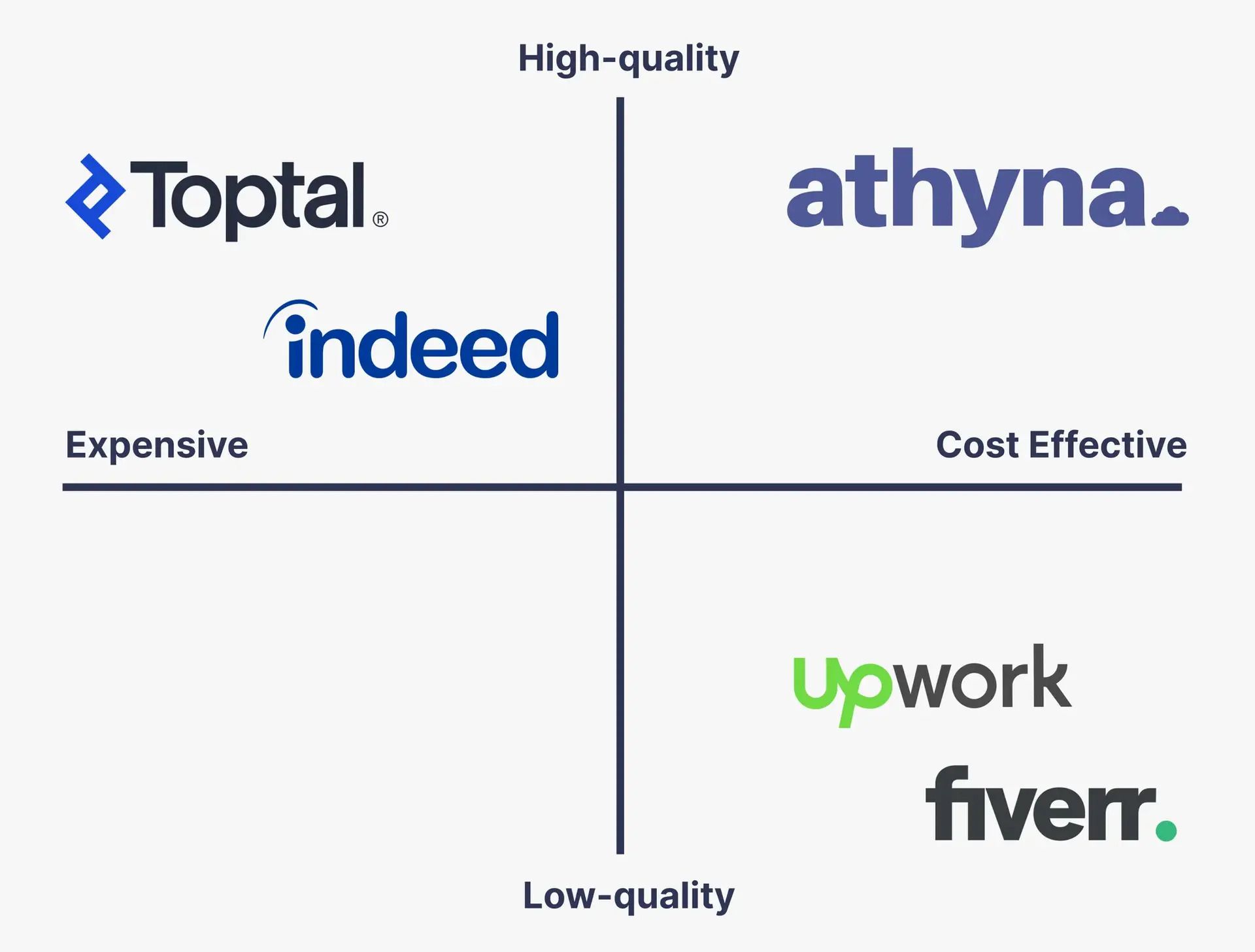

There’s a better way. Athyna helps you build high-performing teams—fast, affordable, and without the hiring headaches.

Here’s how:

🤖 AI-powered matching connects you with talent tailored to your needs.

⚡ 4 days from brief to interviews.

💸 Save up to $80K per hire with top LATAM engineers.

Speed, precision, and serious savings—no compromises.

👉 Ready to change the way you hire?

👥 People Moves 👥

👥 After a decade of experience as General Partner at Titanium Ventures (formerly Telstra Ventures, ~$1.8B FUM), Albert Bielinko joins Folkore Ventures as Partner.

Here’s some history on Titanium Ventures and Bielinko’s experience. Telstra Ventures was founded in 2011 as the corporate-venture arm of Telstra Corporation Limited, with a global VC remit. He invested in startups like OpenSolar, Enable, Samsara Eco, Auth0 and MOVUS.

In 2018, the fund spun out from Telstra and began operating independently, although still branded as Telstra Ventures. On 24 June 2024, the firm officially rebranded from Telstra Ventures to Titanium Ventures.

The rebrand also aligned with Telstra’s strategy to exit its venture-capital investments: Telstra publicly stated it was “exploring options to sell our current investments in Telstra Ventures’ funds” in pursuit of capital discipline and active portfolio management.

💰 M&A 💰

🕹 Indian gaming giant Zupee has acquired Sydney AI startup Nucanon for $5M, with a further $15M committed for growth (Capital Brief)

Founded in 2023, Nucanon built an adaptive storytelling AI where characters remember past interactions and narratives shift dynamically, attracting early backing from Antler, Skalata, Outlier Ventures, Futureverse, Paperclip, LAUNCH Fund, and others.

Co-founders Nilushanan Kulasingham and Brijesh Trivedi will join Zupee in India as the company pivots from B2B to B2C, targeting a massive 1.4B-person market with Zupee’s platform that apparently has 200M users across various games.

🥳 Wins 🥳

⛳ Future Golf, the golf agnostic club membership community, has partnered with MiClub to launch full tee-sheet integration, delivering real-time, seamless bookings directly through the Future Golf app. (LinkedIn)

Queensland is the first state to be live, with the rest of Australia rolling out in the coming weeks.

Over 200+ partner courses, now get complete control over access via their own tee sheet, plus richer booking data including name, email and handicap of Future Golf’s 40,000+ members. The integration is expected to cut pro-shop phone calls, streamline operations and improve the experience for both clubs and members.

⚕ WA has awarded nearly $5M to 12 startups and researchers developing cutting-edge medical and health technologies, with grants ranging from $90k to $500k under the Innovation Seed Fund 2024–25 program. (WAFHRIF Announcement)

DermR Health Research WA – Advancing the DermR Patch α2 for early clinical validation and design refinement. (Funding: $500,000)

Curtin University – LIVER-Trace, a blood test for early detection of liver cancer recurrence. (Funding: $499,939.80)

Respirion Pharmaceuticals – Inhaled RSP-1502, a next-gen treatment for resistant infection and inflammation in cystic fibrosis. (Funding: $649,312)

Murdoch University – NeoSep-4, a four-marker rapid point-of-care test for neonatal sepsis. (Funding: $99,842)

ProGenis Pharmaceuticals – Nucleic acid therapy to revolutionise aortic stenosis treatment. (Funding: $100,000)

University of Western Australia – Every Heartbeat Matters, a pocket-sized radar device for at-home advanced heart monitoring. (Funding: $99,937)

Kids Research Institute / UWA – First-in-class small molecules to improve outcomes in asthma. (Funding: $499,640)

Australian Institute of Robotic Orthopaedics (ArthoLase) – Local manufacture and qualification of the HAiLO™ robotic-assisted laser arthroplasty system. (Funding: $496,332)

Proteomics International – Promarker Endo, a blood test for early and accurate endometriosis diagnosis. (Funding: $500,000)

Biotome – Project Hummingbird, a novel diagnostic for assessing preeclampsia risk. (Funding: $498,000)

Pretect Devices – MVP development of Vedette, a device preventing extravasation injury in neonates. (Funding: $494,821)

Materia Health – MateriaPOD, a new standard for safe organ and tissue transportation. (Funding: $500,000)

📆 Notice Board 📆

🌏Demo the Future: Techstars Tech Central Sydney Accelerator Demo Day is bringing 2,500+ founders, investors, and innovators together for one epic night. They’ve landed Ben Shewry as the keynote speaker. Get your ticket before they sell out.

🚀 See 12 bold startups take the stage, Mon, 8 Dec 2025 | 6–8pm | Darling Harbour Theatre, ICC Sydney 👉 Register now

🎾 AO StartUps has opened its final intake for 2025, with a focus on AI technologies set to transform global sport and entertainment. (AO Announcement)

The program is a key pillar of Tennis Australia’s innovation and VC strategy, giving startups the chance to pilot cutting-edge tech at the Australian Open and across major TA events. Applicants must show strong potential to impact the global sports and entertainment ecosystem, especially through AI-driven fan, player and event experiences.

Early-stage tech companies have until 30 November 2025 to apply here.

📈 Level up your pricing strategy and win more customers. Join a one-day pricing masterclass to level up your pricing and positioning strategy. Tie your value and differentiation to your price to convert more customers, more easily!

Wednesday, November 26 in Melbourne, fully catered + workbook included

Completely hands-on day, implement learnings while you're still in the class! Grab your spot here.

Would you like to promote an event or an opportunity? Enquire about a Notice Board promotion here.

🧠 KaaS (Knowledge as a Service)

Will’s Pick 💁 Understanding Neural Networks, Visually by visualrambling.space

This is a beautiful, simple explainer of how AI neural networks work at their most basic level. I think this is best experienced on a computer, but there’s something incredible about how the magic I use every day works.

Will’s Pick #2💁 AI eats the world, a presentation by Benedict Evans.

You can also find the video presentation here. Ben does a great job of simplifying large concepts into simple language and frameworks to explain where we’re at with AI and where it’s going. Plus, Garry Tan put together a nice tweet thread around this presentation to define startup moats and opportunities.

Have we missed something? Got some feedback? We love emails, so send one over!

👔 Connect with me on LinkedIn: Overnight Success, Will Richards

📈 Want to invest in great startups? Join Australia’s friendliest investment syndicate here, where small cheques are welcome!

🚀 Want to get your product in front of ~5,000 founders, investors and operators building scaling startups? Email us to learn about our sponsor and partner opportunities.

📣 Have you just raised capital and you’re looking for a hand with PR and comms to make a splash, hire the best talent and get on the radar of your next investors? The team at Encour and I would be happy to help. Book in with me for a chat here.

❤ Getting a bunch of value from OS and want to support our growth? Consider becoming an OS Superhero.

‘Til next time,

👋 Will