G’day and welcome to your weekly edition of Overnight Success - your download on all the important things that have happened in the Aussie startup ecosystem. 🚀

This week, we dive into breaking news at Airwallex, following their announcement of a lawsuit at Nine Media. Australia welcomes its newest Unicorn, with Gilmour Space’s Series E. At the bottom of the newsletter, I’ve looked at the drop in SaaS multiples in the public markets following the release of Claude Cowork a few weeks ago and pose a question to you: Will AI disrupt SaaS as we know it? Check out the live poll below.

Plus, want to learn how Blinq grew explosively to 2.5M users by obsessing over a single product experience? Founder Nick Hutton broke down the strategy in this article, which he guest-wrote for OS.

👀 Headlines 👀

👀 For a company that took to suing the media to remove negative articles, and put out advertising to pay influencers to praise their founders' “thought leadership”, Airwallex has had a terrible week of news. The FinTech has been ordered to undergo an external audit by Australia’s financial crimes watchdog over suspected “serious non-compliance” with anti-money laundering and counter-terrorism financing (AML/CTF) laws. (The Age, AFR, Capital Brief, Innovation Aus)

AUSTRAC said it was concerned that Airwallex’s transaction monitoring systems were inadequate for the risks it faces, and that the company had not demonstrated an acceptable understanding of its customers or its reporting obligations.

AUSTRAC chief executive Brendan Thomas said the agency also had concerns about Airwallex’s ability to identify and report suspicious matters linked to fraud, scams, illicit tobacco, drug trafficking and child sexual exploitation.

The regulator said it takes such action only where it suspects serious non-compliance, stressing that AML/CTF obligations require active oversight from boards and senior executives, not just back-office processes.

The company noted it was previously audited in 2024 and said it was found at the time to have implemented appropriate AML/CTF systems and controls, with zero tolerance for financial crime.

The externally appointed auditor will have 180 days to report findings to AUSTRAC, with the scope set by the regulator and the cost borne by Airwallex.

Founded about a decade ago in Melbourne by CEO Jack Zhang and co-founders, Airwallex now operates dual headquarters in Singapore and San Francisco and processes more than US$235 billion in payments annually across 120+ countries.

Startup Daily’s Simon Thomsen wrote a good piece on Airwallex's history with the media, and the broader startup sector in general, with dashes of advice for founders and startups throughout.

🦄🚀 Gilmour Space Technologies raised a $217 million in Series E funding led by the federal government’s National Reconstruction Fund, cementing the space company’s status as Australia’s newest minted unicorn. (Capital Brief, SmartCompany)

The deal thrust the National Reconstruction Fund back into the spotlight, marking its most high-profile investment since launching three years ago.

The investment reflects the original vision championed by former industry minister Ed Husic, who argued Australia’s economic future lay in backing complex, advanced manufacturing. Full raise write-up below!

💽 After being founded in Tassie and headquartered in Singapore, Firmus Technologies has opened a Sydney CBD office as it builds towards an IPO. (Capital Brief)

Firmus said the Sydney office will house its rapidly growing workforce, while it retains staff in Tasmania and keeps its headquarters in Singapore during the IPO run-up. Sources close to the company say Firmus has not yet received ASX pre-approval, casting doubt on market speculation of a pre-April float.

The ASIC lodgement confirms former Xero executives Kirsty Godfrey-Billy and Nicole Reid as directors, taking on CFO and Chief People Officer roles respectively. Firmus was co-founded in 2019 by Tim Rosenfield and Oliver Curtis, with the board recently bolstered by chairman Grant Dempsey and independent director Mike Ferraro.

Now valued at roughly $6 billion, Firmus counts Regal Funds Management, Ellerston Capital and Wilson Asset Management amongst its largest shareholders.

🤝 Swipejobs, the AI-powered jobs platform founded by Australian entrepreneur Katrina Leslie, generated $1.3 billion in revenue in 2025 and is preparing for an ASX listing this year. (AFR)

The 10-year-old company employs more than 800 people, has been profitable for six consecutive years, and expects its revenue run-rate to hit $1.8 billion in 2026.

Swipejobs uses AI-driven “dynamic matching” to continuously update job matches for workers based on skills, preferences and real-time feedback, positioning workers - not employers - at the centre of the hiring process.

Founded in 2014 and built largely in Australia for US and UK markets, Swipejobs will launch locally in Australia in 2026 after a decade of offshore focus.

Leslie still owns close to 70% of the company, placing her on track to join Australia’s billionaire ranks following the IPO. Leslie self-funded the business for its first six years before raising a quiet $80 million round in 2020 from high-net-worth Australian investors, including Caledonia, Audant Investments and Ironbridge Capital.

💰 The Australian Government has awarded more than $72.5 million through the latest round of Australia’s Economic Accelerator (AEA) Ignite program to help universities fast-track research into real-world, commercial outcomes.

The round saw record demand, with applications more than doubling to 838 submissions across 35 universities, resulting in 174 funded projects from 27 institutions.

Full write-up in the Wins section below with a link to the full list of funded projects.

Everything you learned about writing at university was wrong.

That is why so many smart founders, operators and investors still send long emails and confusing updates.

Power Writing teaches operators how to write with precision, clarity and authority, so your emails get answered, your memos get read and your ideas drive action.

Built by a former banker and now startup operator.

Learn how to:

Drive decisions in fewer words

Be concise without losing authority

Structure documents senior people actually read

Use code OVERNIGHTSUCCESS for $100 off.

Most people use their work L&D allowance to pay for it. Master the #1 skill you use every day.

⚡ Startup Retro ⚡

Gilmour Space hits unicorn valuation with $217M Series E to get Australian rocket into space

Founders: Adam Gilmour, James Gilmour

Gold Coast-based rocket startup Gilmour Space has joined the unicorn club after closing a mega Series E round that values the company at more than $1 billion. Gilmour Space is building rockets and satellites for commercial, defence and government customers, raised $217 million following a high-profile maiden launch in July. The test flight lasted just 14 seconds before crashing back to Earth, but it was still deemed a success and helped unlock fresh capital for a string of future launches.

The round was co-led by the National Reconstruction Fund and superannuation giant Hostplus, which each committed $75 million. New investors include the Future Fund, Funds SA and Brighter Super, while existing backers such as HESTA, Blackbird, Main Sequence, QIC and NGS Super also returned.

The company is aiming to compete with SpaceX and Rocket Lab by delivering satellites into orbit. Gilmour Space is also developing its own satellites, with its first 100kg ElaraSat already launched into orbit aboard a SpaceX rocket last year.

It currently employs more than 220 people and plans to hire another 50 this year. Gilmour said the enlarged round gives the company enough capital to attempt multiple launches as it works towards reliable orbital capability. The startup is now planning to extend the raise with US investors as early as next month.

Due Diligence: ABC, AFR, The Australian, Capital Brief

Omniscient Neurotechnology lands $36M to unlock the power of brain mapping

Founders: Dr. Michael Sughrue, Dr. Stephane Doyen

Now an American-based neuroscience startup, but founded in Sydney, Omniscient Neurotechnology has closed a $36 million Series D, with the National Reconstruction Fund (NRF) tipping in $20 million as co-lead alongside OIF Ventures.

Founded in 2019, Omniscient uses artificial intelligence to map the brain’s neural connections from MRI scans - a field it calls “connectomics”. Its proprietary platform, Quicktome, generates personalised brain maps that enable neurosurgeons to plan procedures based on each patient’s wiring, rather than relying on standard anatomical diagrams.

Quicktome has already been approved by the US Food and Drug Administration and is in use at major hospitals and research institutions globally. The fresh capital will be used to further commercialise Quicktome, expand Omniscient’s data science team, and develop next-generation clinical applications. The company currently employs 16 people in Australia and plans to create 40 new highly skilled roles across AI, neuroscience and product development.

CEO Stephen Scheeler, the former Facebook ANZ boss, said Omniscient has a five-year plan to establish a connectomics centre of excellence in Sydney and continue expanding its footprint in the US.

Omniscient’s Series B in 2021 was backed by an unusually heavyweight syndicate of Australian money, led by Caledonia co-chief investment officer Will Vicars and featuring several of the country’s richest families. The $40 million round, struck at a pre-money valuation of roughly $400 million, included billionaire mining magnate Gina Rinehart, philanthropist Gretel Packer, and Platinum Asset Management co-founder Kerr Neilson. Vicars had already anchored the company’s earlier seed round, placing half of the initial $20 million and helping to attract other high-profile backers into the business.

Due Diligence: Startup Daily

Ivo hits US$530M valuation following $81M Series B to scale AI for legal teams

Founders: Min-Kyu Jung, Jacob Duligall

Blackbird has doubled down on legal AI startup Ivo, leading a US$55 million Series B round that values the New Zealand-born company at US$530 million.

Founded in 2021 by former corporate lawyer Min-Kyu Jung and ex-Xero engineer Jacob Duligall, Ivo builds AI software for in-house legal teams to review contracts, flag risks and generate context-aware redlines - directly inside Microsoft Word. The company says customers save up to 75% of the time spent on manual contract reviews, without sacrificing accuracy.

Ivo already counts Uber, Shopify, Atlassian, Reddit and Canva as customers, and has seen rapid momentum over the past year. Since its last round, annual recurring revenue has grown more than 500%, total customers are up 134%, and Fortune 500 adoption has expanded 250%.

Unlike general-purpose AI tools, Ivo breaks document review into hundreds of tightly scoped tasks, chaining together more than 400 model calls per contract to deliver what Jung describes as “surgical, context-aware” legal output that mirrors a human lawyer’s style.

Over the past 12 months, the company has launched three major products: a native AI assistant in Word, a multi-agent legal research tool drawing on more than 100 sources, and an intelligence platform that connects historical contracts with future negotiations.

The round was backed by Costanoa Ventures, Uncork Capital, Fika Ventures, GD1 and Icehouse Ventures. Blackbird principal James Palmer will join Ivo’s board as the company pushes to own the entire contracting workflow.

More reading: Blackbirds Investment Notes: Ivo Series B

Elyos AI raises US$13M Series A to build AI voice agents for tradespeople and field services

Founders: Adrian Johnston, Pip Brown, and Panos Stravopodis

London-based startup Elyos AI has raised US$13 million in a Series A round as it builds AI agents for trades and field services businesses.

The round was led by Blackbird Ventures, with participation from Y Combinator and Pi Labs, bringing Elyos AI’s total funding to US$16 million. Founded in 2023 through Y Combinator by Adrian Johnston, Philippa Brown (from NZ) and Panos Stravopodis, the company sells software to plumbers, electricians, HVAC providers and facilities operators.

Elyos AI’s agents automate customer communications and operations across phone and email, handling inbound calls, outbound follow-ups, missed calls and booking workflows. The platform integrates with the field service and CRM systems already used by trade businesses, aiming to replace overstretched front-office teams with always-on AI.

For tradespeople who are often working away from their desk on the road, the agents manage booking, dispatch and follow-ups, helping businesses capture more jobs during peak call periods when technicians are on-site, and admin teams are thin.

Customers report higher booking rates, faster response times and fewer missed calls. Fire and security contractor Amax says Elyos AI now handles 30% of its technical calls without human intervention.

Elyos AI plans to use the new capital to expand its engineering and go-to-market teams, deepen CRM integrations and launch new AI agent features across voice, email and messaging, ahead of international expansion in 2026.

Due Diligence: ITBrief

More reading: Blackbirds Investment Notes: Elyos Series A

Become a confident angel investor!

Australia’s startup ecosystem is booming — but how do you actually get started as an angel investor? Overnight Success has partnered with the team at Aussie Angels on their excellent Angel Academy.

Angel Academy takes you inside the playbook: the terms, the thematics, the mindset, and the risks. It’s a comprehensive, engaging course featuring insights from some of the country’s most recognised investors.

If you’ve ever wanted to move from watching the headlines to backing the founders, this is your entry point.

👉 Enrol now for a limited time with code OVERNIGHT for discounted access.

👀 Aussie Raisins👀

🏏 Amsterdam Flames is seeking US$3 million (~AU$4.45 million) at a US$20 million pre-money valuation, offering about 15 per cent of the franchise, with proceeds to fund operations, branding and commercial scaling through the first formative seasons. (BBC)

The European T20 Premier League is launching in August 2026 as a new, ICC-sanctioned Twenty20 competition aimed at turning Europe into cricket’s next major growth market.

The league is positioning itself as a franchise-based sports and media platform modelled on the success of the Indian Premier League, with centralised revenues from broadcast, sponsorship, ticketing and commercial rights.

The Amsterdam Flames franchise raise is being led and promoted by a group of prominent Australians, including former national captain Steve Waugh, ex-KPMG partner Tim Thomas and Australian Olympic hockey great Jamie Dwyer.

The Amsterdam Flames investor pitch highlights plans to build a $100 million-plus global sports and media business within five years, anchoring early revenue in the league’s central commercial pool. The franchise has already signed players such as former Australian Test captain Steve Smith, Australian T20 captain Mitch Marsh, Netherlands skipper Scott Edwards and T20 star Tim David.

🥳Wins 🥳

🗺️ Q-CTRL says it has solved aviation’s growing GPS jamming crisis with quantum-powered navigation systems that deliver GPS-like accuracy without relying on satellite signals. (Capital Brief)

The technology uses quantum sensors to maintain precise positioning even when GPS is jammed or spoofed, addressing a problem that now disrupts more than 1,000 commercial flights globally every day.

Unlike traditional GPS, which depends on weak satellite signals, Q-CTRL’s system is self-contained, making it resilient to low-cost jammers that can otherwise knock out navigation across entire flight corridors.

CEO Michael Biercuk describes the breakthrough as “actual commercial quantum advantage”, comparing its significance to the introduction of atomic clocks in aviation decades ago.

For pilots, the solution removes cascading system uncertainty triggered by GPS loss, where terrain warnings and navigation failures can undermine confidence in multiple aircraft systems at once.

The company has already deployed the technology across defence, aerospace and enterprise use cases, including systems delivered to the Pentagon and UK defence forces.

Initial commercial shipments begin this year, starting with drones and unmanned platforms, with Q-CTRL expecting the technology to become standard equipment on commercial aircraft over time.

💰 The Australian Government has awarded more than $72.5 million through the latest round of Australia’s Economic Accelerator (AEA) Ignite program to help universities fast-track research into real-world, commercial outcomes.

The round saw record demand, with applications more than doubling to 838 submissions across 35 universities, resulting in 174 funded projects from 27 institutions.

Funding is aligned with national priorities set out under the National Reconstruction Fund Corporation Priority Areas, supporting capability building across all seven targeted sectors.

Projects span enabling capabilities (43), medical science (40), renewables and low-emissions technologies (37), agriculture and fisheries value-add (19), defence capability (18), resources value-add (14) and transport (3).

Funded initiatives range from AI-based health and safety tools to clean energy, advanced manufacturing, space security and critical minerals processing, highlighting the breadth of Australia’s research and commercialisation pipeline. You can see the full list of funded projects here.

Insight

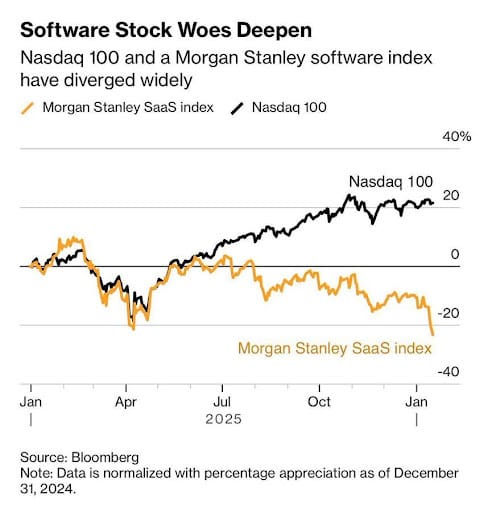

📉 A global sell-off in software stocks has reignited fears that AI agents could undermine the economics of traditional SaaS, after the release of Anthropic’s Claude Cowork triggered the worst start to the year for SaaS stocks since 2022. (Capital Brief) Locally, Atlassian shares have falled 16% since Cowork was launched on Jan 12th. Bloomberg has more.

The central question is not whether SaaS is disappearing, but whether its traditional assumptions around growth, pricing and defensibility still hold in an AI-driven environment. AI is enabling software companies to grow faster than ever by shifting pricing models away from per-seat subscriptions toward work-performed or outcomes-based pricing, massively expanding addressable markets.

Local VC’s (and Chemath Palihapitya) feel that rather than shrinking the software opportunity, AI is accelerating software’s penetration into more parts of the economy, allowing entirely new categories of companies to exist.

For established SaaS incumbents, AI represents both a threat and a once-in-a-generation opportunity: companies with strong distribution and loyal user bases can entrench their position if they adapt quickly, but risk disruption if they do not. Future software moats are likely to come from proprietary data, domain-specific learning loops and demonstrable returns on AI usage, rather than simple workflow automation.

SaaS businesses built on thin workflow layers face heightened risk, as AI agents can increasingly replicate or bypass these interfaces entirely. In contrast, companies with unique data, strong distribution advantages or that solve complex coordination problems are becoming more defensible, not less.

Is traditional SaaS over?

📆Notice Board 📆

🚜 The future of farming is here: evokeAG. 2026 lands in Melbourne (17–18 Feb) Asia-Pacific’s biggest agrifood innovation event is back with bold keynotes, uncomfortable conversations and live tech - including a remote driverless tractor demo from Ornata.

Big-name speakers from across ag, tech and VC, including Halter founder Craig Piggott, Astanor Ventures’ Harry Briggs and SwarmFarm CEO Andrew Bate.

50+ startups and scaleups from 8 countries showcasing everything from autonomous machinery and insect protein to soil intelligence and circular agtech.

Would you like to promote an event or an opportunity? Enquire about a Notice Board promotion by replying to this email.

🧠 KaaS (Knowledge as a Service)

Will’s Pick 💁 Patrick O’Shaugnessy - Creating on Principle (Invest Like the Best) podcast with David Senra interviewing Patrick

Why Should You Listen? I don’t think I’ve ever heard Patrick be interviewed, so for me it was awesome to hear the operating system of one of the world's best interviewers.

While this conversation does touch on business, this is largely a philosophical conversation about how to live a good life, how to spot talent, and the difference between "clean" and "dirty" ambition and what fuels it.

Two powerful takeaways for me were:

Setting goals too prescriptively: Patrick avoids them because they can act as "blinders" on specific outcomes, limiting your ability to see unexpected opportunities on the periphery.

The maxim, "The reward for great work is more work." This shouldn't be viewed as a punishment. Instead, it signifies earning the privilege to do more of what you love on a larger scale.

Have we missed something? Got some feedback? We love emails, so send one over!

👔 Connect with me on LinkedIn: Overnight Success, Will Richards

📈 Want to invest in great startups? Join Australia’s friendliest investment syndicate here, where small cheques are welcome!

Want better startup data? Check out our startup deals database used by VCs, founders and business development teams to stay across all the high signal data.

🚀 Want to get your product in front of ~5,200 founders, investors and operators building scaling startups? Email us to learn more about our sponsorship and partnership opportunities.

❤ Getting a bunch of value from OS and want to support our growth? Consider becoming an OS Superhero.

‘Til next time,

👋 Will